Financial institutions must play a key role in detecting and identifying migrant smuggling because criminal organizations are now exploiting the situation

The disturbing headline of 39 migrants found dead in a refrigerated truck in Essex, England is just the latest story of migrant smuggling that resulted in tragedy. Financial institutions can and must play a key role in detecting and identifying migrant smuggling because criminal organizations are exploiting migrants’ desperation, often at a deadly price.

(Note: This article will refer to Migrant Smuggling as opposed to Human Smuggling to avoid confusion with the separate but occasionally overlapping crime of human trafficking.)

What is Migrant Smuggling?

The United Nations describes the combination of elements that make up migrant smuggling as:

Either the procurement of illegal entry or illegal residence of a person into or in a country of which that person is not a national or permanent resident, for the purpose of financial or other material gain.

In most instances, the relationship between the migrant and smuggler ends once the destination country has been reached. The fee paid to smugglers is a factor of the distance from source country to destination country, border crossing difficulty, and mode of transport.

How do Migrant Smuggling Organizations Operate?

Migrant smuggling operations are not monolithic, and can range from small, ad hoc groups to transnational organized crime syndicates. Sophisticated migrant smuggling rings operate like any large business, with different individuals playing distinct roles. The head of the smuggling ring, known as the “coordinator” or “controller”, is at the top of the food chain and brings together all the necessary players.

Key operatives include recruiters who advertise their services to lure new migrants, often using social media sites like WhatsApp, Facebook, and SnapChat to advertise their services. Lower-level employees are responsible for tasks such as transporting migrants, serving as guides, spotters, drivers, and enforcers. Smugglers often hire “gig economy” drivers and other service providers, often obtaining these services through social media sites as well.

Outsourced service providers can include hotels, travel agencies, and restaurants. Smugglers may bribe individuals who are employed by airlines, boat marinas, and railways to facilitate the crime. Finally, smugglers will need to utilize financial institutions to receive or launder fees from migrants and pay expenses.

Corruption and bribery of public officials, including border police, embassy officials, and custom inspectors, have all been documented in relation to migrant smuggling.

Financial transactions like restaurant purchases, gas station fill-ups or bank visits that might be mundane in a normal business can be key to law enforcement agencies that are investigating migrant smuggling organized crime rings. The transactions’ geographic locations could point to a smuggling route, previously unknown associates, or could lead to the higher-ups in the criminal organization.

How Smugglers are Paid by Migrants

The timing and method of payment by migrants to smugglers can affect the relationship power dynamic and ultimately impact the safety of the migrant.

In advance — One of the victims in the truck tragedy is reported to have paid £30,000 to be smuggled from Vietnam to England. Migrants have historically paid smugglers in cash, fund transfers, and via trust systems, like Hawala. Advance payment methods often rely on trusted third parties to act as intermediaries to hold the migrant’s funds until the destination country has been safely reached.

En route — U.S. Border Patrol interviews with migrants found that smuggling fees are often paid in stages, with initial fees required to approach staging locations along the southwest border and then a final payment at the destination.

On credit — This renders migrants particularly vulnerable to trafficking or debt bondage.

Finally, migrant smuggling operations may double as drug smuggling routes along the U.S. southwest border by requiring migrants to carry controlled substances as an alternative means of payment.

FinCEN Advisory on Migrant Smuggling

A 2014 FinCEN Advisory provided guidance to financial institutions on identifying and reporting suspicious financial activity connected to migrant smuggling.

Many of the red flags the Advisory cited were focused on unusual wire patterns; for example, funds wired from countries with high migrant populations to southwest border counties, or multiple unrelated persons sending wires to the same recipient. Funnel accounts may receive cash deposits in locations where the customer does not reside or via checks deposited with inconsistent handwriting. Migrant smugglers may exchange smaller bills for larger denomination bills in advance of bulk currency shipments and have cash receipts inconsistent with the customer’s stated line of business.

Insights from Migrant Smuggling SARs

In 2018, Human Smuggling was given its own category on the SAR form. Analysis of Human Smuggling SARs can provide new insight on how financial institutions are responding to this issue.

Money Services Businesses

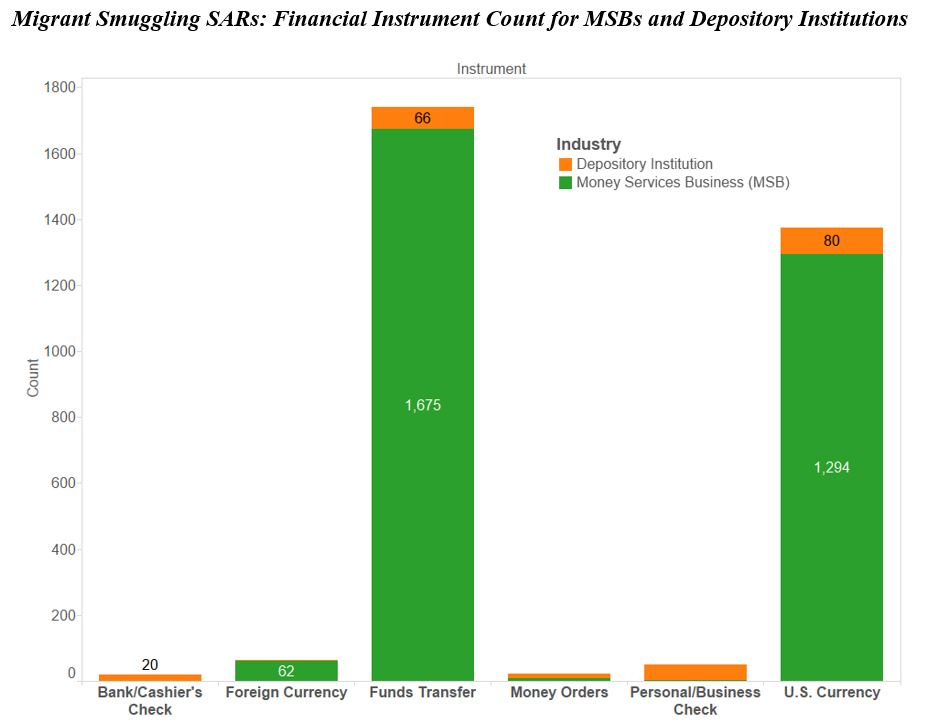

Money Services Businesses (MSBs) have reported the lion’s share on Human/Migrant Smuggling SARs, accounting for 87% of all Migrant Smuggling SARs.

MSBs identified funds transfers as being used in 55% of Migrant Smuggling SARs while U.S. currency was used in 42%. Migrant smuggling SAR reporting locations were concentrated on the southwest border with seven of the eight top Smuggling SAR counties located in Texas. Finally, MSBs identified more than six relationships (customer, agent, etc.) for each Smuggling SAR.

Depository Institutions

Depository Institutions filed 206 Human/Migrant Smuggling SARs over the same period. Banks identified U.S. currency as used in about 38% of the filings, fund transfers in 32%, and personal or business checks in 22% of the SARs. Despite FinCEN’s Advisory regarding “funnel accounts” and unusual wire activity, only 73 SARs and 66 SARs, respectively, were filed reflecting deposit accounts or wires.

The geographic data reported indicates that bank back-offices identified the suspicious activity as opposed to bank branches. Finally, banks identified 2.4 relationships per Migrant Smuggling SAR.

Emerging Methods

Pre-paid cards, digital payment methods, and virtual currencies offer new ways for smugglers to conduct their business. Financial institutions need to incorporate these new payment systems into their Migrant Smuggling detection scenarios.

Similarly, banks should consider including social media monitoring into detection scenarios as well because smugglers have adapted well to this technology.