The new Legal Tracker Legal Department Operations Index Report highlights qualitative and quantitative insights into corporate legal department operations

At times, the most profound insight can be found not by considering what has changed, but instead by focusing on what has remained the same.

This fourth edition of the Thomson Reuters Legal Tracker™ Legal Department Operations (LDO) Index Report expands our commentary to include analysis of the data over the four editions of the LDO Index Report (Spring 2017, Fall 2017, 2018, and now this edition).

We feel this insight may better illuminate where successful trends have caught on, and in what areas of legal department operations more attention is needed.

For example, our trend-over-time data has shown that in each edition of the LDO Index Report thus far, legal department staff have been increasingly relied upon to do more. More than two-thirds (68%) of legal departments surveyed in the 2019 edition of the report said they are facing increasing legal work demands — the highest level recorded in the report’s history.

Also, 57% of legal departments are saying they have dedicated legal operations functions, even though the percentage of legal departments increasing their staff specifically dedicated to legal operations decreased slightly, to 17%.

Statistically speaking, these numbers offer a vivid illustration of the pressure to do more with less.

In-House vs. Outside Counsel

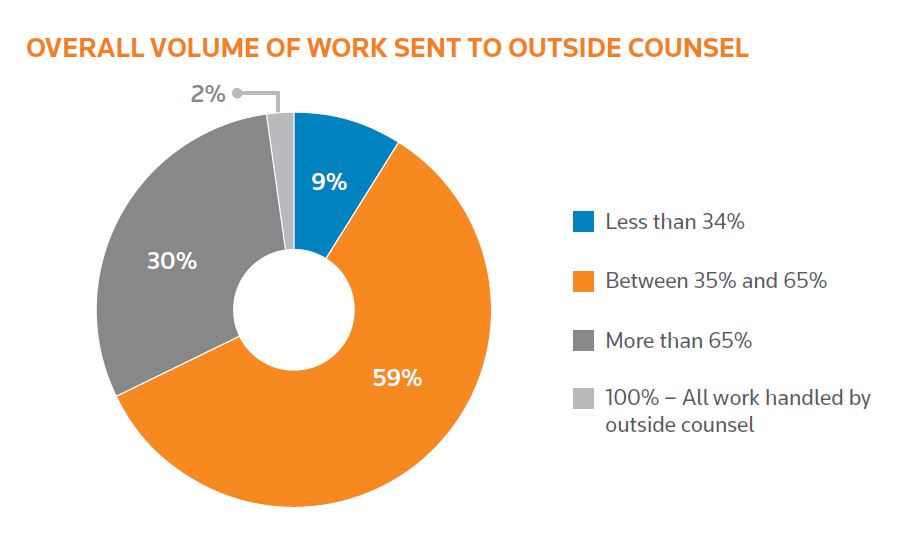

Another trend-over-time revelation can be seen by looking at the amount of work kept in-house instead of being sent to outside counsel. More than half of the respondents have reported increasing the percentage of work handled in-house in each report, apart from Fall 2017. Not surprisingly, the percentage of those departments increasing their outside counsel spending fell to 47%, the lowest since Fall 2017.

Given that, it was little surprise that controlling cost remains the most common high priority cited by the legal departments surveyed, with 90% ranking cost control as high priority.

Legal departments also say they are utilizing a number of critical strategies to manage this combination of increased workload and budgetary pressure. These strategies generally involve analyzing and attempting to improve the department’s approach to people, process, and technology in order to lower costs, promote efficiency, and deliver more consistent high-quality legal work to their organization.

To better delve into this concept, the report revolves around three key themes:

- the composition of Legal Operations, including the role of dedicated legal ops professionals, the trend of in-house/outside counsel ratios, staffing, diversity, and metrics;

- Spend Management, including sophistication, cost control measures and effectiveness, timekeeper rates, and alternative fee arrangements (AFAs); and

- Legal Technology, including the ranking of key solutions and emerging technology trends.

The report also includes benchmarking data, comprised of more than $90 billion in legal spending from more than 1,400 legal departments and 62,000 law firms, as well as responses to a survey of corporate legal departments that use Legal Tracker, which was conducted in July 2019. The survey received responses from 210 legal departments, including 75 companies in the Fortune 1000, and responses across 34 industries, including strongest participation from companies in the Healthcare, Financial Services, Energy & Utilities, Manufacturing, and Retail industries.

Overall, this edition of the LDO Index paints a picture of the top trends remaining relatively unchanged over the past three years — with corporate law departments continuing to face increasing work levels, significant budget pressure, and growing legal technology adoption.

As the challenges remain relatively unchanged, the report reveals legal departments are following the general direction of law firms and the rest of the legal industry — driven to pursue their desire to increase efficiencies by doing more with less.